In terms of recognition and respect, behavioral economics has certainly come a long way in the last 25 years. But it is still a Hibernian outpost in the great Roman Economics empire. One of the newest metrics for evaluating its impact is the auto-suggest feature in many search engines that has become quite popular since Google aired its ode to the long-distance romance during the Super Bowl.

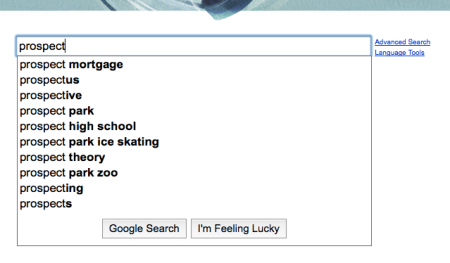

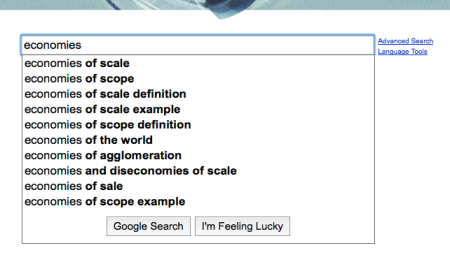

In order to compare regular economics and behavioral economics, the Nudge blog typed in the first word of a few major concepts from each field into Google.

From economics, there is “supply and demand,” “opportunity cost,” and “economies of scale,” all of which appear to be quite popular. Notice that the phrases themselves are popular, as well as ones that add “examples” to the end of the phrase.

From behavioral economics, there is “prospect theory,” “endowment effect,” and “bounded rationality.” The first two still have a ways to go before becoming part of everyday parlance. Bounded rationality, on the other hand, looks potentially well positioned to make it. Of course, how many phrases out there start with “Bounded”? More or less than phrases that have “ou” as the second and third letters in the first word? (That’s a behavioral economics special for all the careful readers out there.)

From behavioral economics, there is “prospect theory,” “endowment effect,” and “bounded rationality.” The first two still have a ways to go before becoming part of everyday parlance. Bounded rationality, on the other hand, looks potentially well positioned to make it. Of course, how many phrases out there start with “Bounded”? More or less than phrases that have “ou” as the second and third letters in the first word? (That’s a behavioral economics special for all the careful readers out there.)